Big data has led to many important breakthroughs in the Fintech sector. The industry is growing at a remarkable rate due to this new technology.

Positive customer experience sits atop the most valuable things critical to the longevity of any business. It helps build brand reputation, enhances a company’s visibility, and encourages customer loyalty, which translates to increased revenues.

Statistics show that 93% of customers will offer repeat business when they encounter a positive customer experience. For these reasons, fintech companies actively seek opportunities to nurture better customer experiences.

Global companies are projected to spend $19.8 billion on financial analytics by 2030. The fintech sector will be among the biggest proponents.

And Big Data is one such excellent opportunity!

Big Data is the collection and processing of huge volumes of different data types, which financial institutions use to gain insights into their business processes and make key company decisions.

This article focuses on big data in financial industry, its role, and how it helps fintech companies protect their customers and improve the customer experience.

The Role Of Big Data In Fintech

We have witnessed huge advancements in the financial industry’s service provision, thanks to big data.

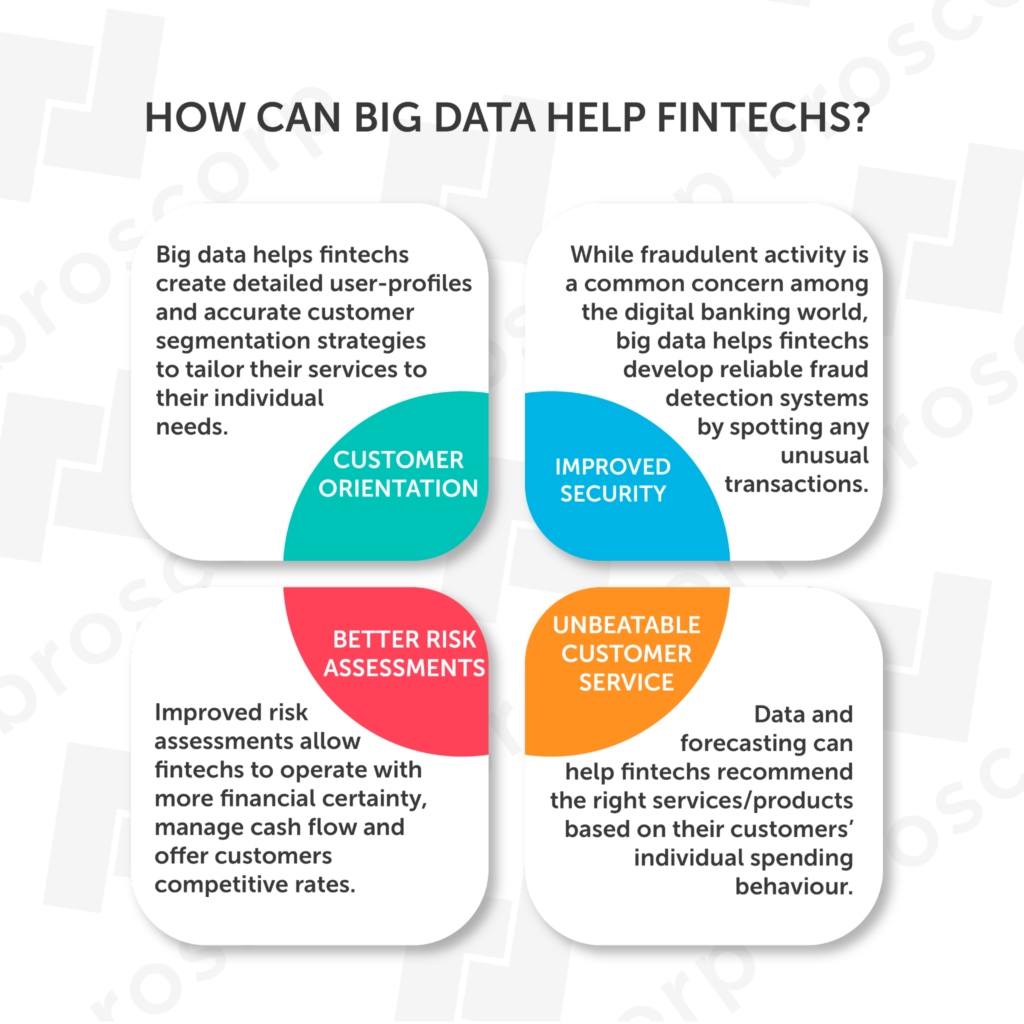

Big data in fintech plays a vital role, providing crucial content that impacts service delivery. Through big data insights, financial institutions can offer personalized services as well as predict consumer behavior. They can also anticipate industry trends, assess risks, and make strategic steps to elevate the customer experience.

How Big Data Helps Fintech Companies And Startups To Better Serve And Protect Their Customers

Fintech analytics helps businesses in the financial and banking industry offer satisfactory services by:

Enhancing View Of Customer Profiling

Big Data provides data that fintech companies can leverage to build customer profiles. Through segmentation, these institutions can easily understand customer wants, needs, and expectations. They can also use this information to analyze consumer behavior and create tailored services.

Improving Risk Assessment

Data analytics fintech provides crucial information financial institutions need to build a robust risk assessment strategy. This allows businesses to identify potential risks fast and avoid them or immediately find the appropriate mitigation strategies.

Improving Security

Fraud is a cause for concern in the banking industry, especially now that mobile banking takes a center stage. However, fintech businesses can use big data and machine learning to build fraud detection systems that uncover anomalies in real time. They will detect illicit activities such as suspicious transactions, logins, and bot activity.

Forecasting Future Market Trends

Start-ups and established fintech companies can use big data to understand the changing financial industry. With access to previous data, these companies can monitor purchasing behavior and predict future trends. As a result, they can make crucial decisions that elevate customer experience, based on these facts.

Personalizing Assistance With Chatbots

Businesses in the Fintech industry can harness the power of big data to personalize chatbot customer service. AI-powered chatbots will access raw data, allowing them to answer customer questions accurately and straight to the point.

Ensuring Friction-less Multi-channel Experience

Changing consumer preferences and the need to capture market share drove financial institutions to embrace multi-channel service delivery. To ensure their customers have a satisfactory experience, financial businesses will use big data analytics to tweak their services across various platforms to suit a customer’s needs. They will also use historical and real-time data to identify possible customer challenges.

How Can Big Data In Fintech Influence The Customer Experience?

Data science in fintech has influenced customer experience in more ways than one. Thanks to it, the financial industry can now:

Analyze customer behavior to propose new products

Customer likes and dislikes shift depending on need. Historical financial big data helps businesses scrutinize evolving customer behaviors, allowing them to come up with invaluable products and services that streamline banking processes.

An excellent example is how the Oversea-Chinese Banking Corporation (OCBC) designed a successful event-based marketing strategy based on the high amounts of historical customer data they collected.

Better UI/UX based on A/B testing

Thanks to big data, Fintech businesses can access real-time data that shows how users interact with their products, the average time spent on the portal/system/app, and the most-used features.

With such information, these businesses can assess two product versions to see which offers a superior UI/UX design. Additionally, they understand in-depth the differences between the products and how they affect the customer experience.

Analyze customer satisfaction survey results.

Big data evaluates customer satisfaction rates from survey results. For instance, it helps financial institutions identify the rate of and reasons for customer churn, helping them devise newer ways to keep their audience interested in their services. Also, it has been used in the management of product and feature requests, as well as in analyzing customer support ticket trends.

Scoring

Financial companies can provide accurate credit ratings based on the number of missed or delayed payments, how much money a customer owes, and how promptly they make payments.

Fraud detection

Big data for financial services in conjunction with digital technologies such as machine learning has proved fruitful in the detection of suspicious activities. They prevent various types of sophisticated fraud and elaborate hacking attempts.

Deutsche Bank is one such financial institution that is taking advantage of big data analytics to identify techniques used in money laundering, secure the know-your-customer processes, and prevent credit card theft.

Measure the ROI from delivering a great customer experience

With insights from big data, fintech companies can measure the success of their efforts geared toward providing a positive customer experience. By measuring ROI, they can identify where to improve and what to focus on.

The Fintech Sector is Exploding Due to Big Data

Big data is, without a doubt, a tech advancement revolutionizing the Fintech industry. It allows access to large data volumes that can be used to improve a customer’s user experience in retail banking, online trading, and other financial processes. However, to take full advantage of big data’s powerful capabilities, choosing BI and ETL solutions cannot be over-emphasized.

ETL and Business Intelligence solutions make dealing with large volumes of data easy. They support system integrations, helping create reliable data pipelines that deliver actionable insights. Additionally, they help fintech companies predict market trends, driving profitability.