Sales forecasting is an essential process for most businesses.

Sales forecasting is an essential process for most businesses. It helps guide the efforts not only of the sales function but also of finance, operations, manufacturing and customer service. Our recently released sales forecasting benchmark research reveals significant insights and best practices that can help companies optimize the effectiveness of this process. I recently wrote that most sales organizations need to make significant changes to the way they do sales forecasting. In that analyst perspective, I examined aspects of technology that can make sales forecasting a much more efficient process than it is in most organizations that use software not designed for sales forecasting.

This research finds much indecision about making changes to improve the technology for sales forecasting. Half of organizations do not plan to change their vendor for sales forecasting in the next 12 to 18 months, and only 10 percent plan to change, although 8 percent will upgrade to the current vendor’s latest version. For organizations that are planning to change vendors, the most common reason is to speed up the forecasting process (54%); fully half of this group are not satisfied with their current product’s functionality. A substantial number of organizations are dissatisfied with their tools because data gets outdated quickly: One in four ranked this first. This discontent likely reflects the more rapid flow and greater volume of data organizations accumulate today and issues derived from the use of tools like spreadsheets into which people copy and paste data with no direct link to its sources. Yet the pace of business has accelerated along with the mass of data, and sales groups feel pressure to have timely forecasts; this challenge is another reason for improving the tools in use.

Organizations use desktop spreadsheets for many activities, and while they are easily accessible, spreadsheets are not designed for  sales forecasting. Nevertheless the research shows that they are the most commonly used tool for sales forecasting (by 29%); sales force automation (SFA) ranked second, an increase from our past research. The third-most common tool used is analytics and business intelligence (BI, 10%). A range of planning and forecasting applications are used by 16 percent of organizations. Most of this technology was not designed to meet the specific needs of sales forecasting.

sales forecasting. Nevertheless the research shows that they are the most commonly used tool for sales forecasting (by 29%); sales force automation (SFA) ranked second, an increase from our past research. The third-most common tool used is analytics and business intelligence (BI, 10%). A range of planning and forecasting applications are used by 16 percent of organizations. Most of this technology was not designed to meet the specific needs of sales forecasting.

It is not surprising that fewer than one-quarter (24%) of the sales organizations primarily using spreadsheets for sales forecasting are satisfied with their process. Our analysis shows a correlation between spreadsheet use and lack of confidence in the information for sales forecasting: Fewer than one in three organizations relying primarily on spreadsheets (32%) are confident or very confident in the quality of their forecast. Moreover, more than half (59%) said that reliance on using spreadsheets makes it difficult to manage the sales forecast efficiently. Yet despite the evidence that spreadsheets have negative effects on sales forecasting, only 38 percent of heavy spreadsheet users are planning to change their forecasting process in the next 12 to 18 months, fewer than users of SFA (48%) and business intelligence tools (53%). When such an important process as the sales forecast is left to tools not designed for the process, risk increases that sales people will not have visibility into their information, let alone timely knowledge of progress and the source of issues that should be addressed.

On the other hand, the research finds that two in five (40%) organizations use dedicated tools for sales forecasting. Most that do are rather new to the technology; three in 10 have been using it for more than a year, and 10 percent more began in the last year. Currently dedicated sales forecasting software is deployed mostly to users on the front lines of sales: 42 percent of front-line sales managers and 41 percent of the front-line sales team have it available. Those that use dedicated sales forecasting technology find value in it: More than one-fifth (22%) of them said it has improved significantly the outcomes of sales activities and processes, and half (51%) indicated it has improved outcomes slightly. Larger organizations use such applications much more often than smaller ones: More than half (54%) of very large companies that use one have been doing so for more than a year, as have 46 percent of large companies. Another 29 percent of the very large started using a dedicated application in the last year, so nearly four out of five of this size of organization have dedicated software. But more than one-fifth of participants said they have no plans to deploy dedicated software. Asked why, most (58%) said they do not know, which indicates a lack of awareness of the technology and its advantages. One-fourth more (24%) said deploying it will not have a positive impact on business, which indicates a lack of understanding of its benefits. Dedicated applications can contribute to more accurate sales forecasts, but we find that many organizations aren’t prepared to implement them or do not understand why they should.

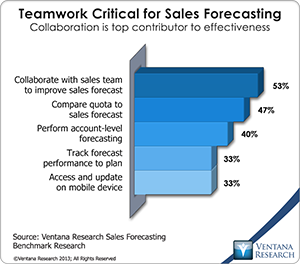

Our analysis finds good reasons for using dedicated technology.  Sales forecasting requires a team effort that involves account managers who track the sales pipeline, operations people and analysts who manage the process and sales managers who approve it and contribute information and metrics. According to our research the most important capabilities for the sales team in the process are to collaborate within the team to improve the sales forecast (selected by 53%), to compare quotas to the sales forecast (47%) and to perform account-level forecasting (40%). These activities make it possible for sales management to compare changes to the forecast, collaborate to address changes and determine actions, and take advantage of operating conditions in sales. The sales operations group processes the sales forecast, from preparing data through presenting the forecast to sales management, and we find that doing so takes a significant amount of time for this essential sales support team – time that could be spent better in applying a range of analytics to the forecast. Sales managers and management have their own priorities, which makes it important to profile the users of sales forecasting and align software capabilities to their roles and responsibilities. Making notations on why the forecast has changed and providing coaching based on the forecast are examples of tasks required to support the sales forecast process that are particularly difficult to do using a desktop spreadsheet.

Sales forecasting requires a team effort that involves account managers who track the sales pipeline, operations people and analysts who manage the process and sales managers who approve it and contribute information and metrics. According to our research the most important capabilities for the sales team in the process are to collaborate within the team to improve the sales forecast (selected by 53%), to compare quotas to the sales forecast (47%) and to perform account-level forecasting (40%). These activities make it possible for sales management to compare changes to the forecast, collaborate to address changes and determine actions, and take advantage of operating conditions in sales. The sales operations group processes the sales forecast, from preparing data through presenting the forecast to sales management, and we find that doing so takes a significant amount of time for this essential sales support team – time that could be spent better in applying a range of analytics to the forecast. Sales managers and management have their own priorities, which makes it important to profile the users of sales forecasting and align software capabilities to their roles and responsibilities. Making notations on why the forecast has changed and providing coaching based on the forecast are examples of tasks required to support the sales forecast process that are particularly difficult to do using a desktop spreadsheet.

Overall our research finds a developing movement to adopt more useful technology for supporting the sales forecasting process. For organizations planning to change, most (40%) are going to use software as a service (SaaS), which is convenient as this cloud-based approach has the lightest burden to install, configure and manage the technology. Nearly as many (35%) plan to use the on-premises approach, which could distract sales from its primary mission and the processes designed to support it. Being able to operate on mobile technology likely will spur adoption as more than half (59%) of participants indicated that mobile technology will help improve the accuracy and timeliness of sales forecasting. We urge organizations to use dedicated software for sales forecasting as a way to improve the outcomes of their sales efforts. Those that do not invest in such software will continue to face impediments in the sales process and risk not achieving the best possible outcomes.

Overall our research finds a developing movement to adopt more useful technology for supporting the sales forecasting process. For organizations planning to change, most (40%) are going to use software as a service (SaaS), which is convenient as this cloud-based approach has the lightest burden to install, configure and manage the technology. Nearly as many (35%) plan to use the on-premises approach, which could distract sales from its primary mission and the processes designed to support it. Being able to operate on mobile technology likely will spur adoption as more than half (59%) of participants indicated that mobile technology will help improve the accuracy and timeliness of sales forecasting. We urge organizations to use dedicated software for sales forecasting as a way to improve the outcomes of their sales efforts. Those that do not invest in such software will continue to face impediments in the sales process and risk not achieving the best possible outcomes.