I recently attended the SAS Analyst Summit in Steamboat Springs, Colo. (Twitter Hashtag #SASSB) The event offers an occasion for the company to discuss its direction and to assess its strengths and potential weaknesses. SAS is privately held, so customers and prospects cannot subject its performance to the same level of scrutiny as public companies, and thus events like this one provide a valuable source of additional information.

I recently attended the SAS Analyst Summit in Steamboat Springs, Colo. (Twitter Hashtag #SASSB) The event offers an occasion for the company to discuss its direction and to assess its strengths and potential weaknesses. SAS is privately held, so customers and prospects cannot subject its performance to the same level of scrutiny as public companies, and thus events like this one provide a valuable source of additional information.

SAS has been a dominant player in the analytics marketplace for years, celebrating its 40th anniversary this year and reporting US$3.16 billion in 2015 revenue. Both of these are significant accomplishments in the software market. And while validation of vendors – including the company’s viability – often ranks as the least important of the seven product evaluation criteria in our benchmark research, SAS’s ranks as one of the most commonly used tools for predictive analytics: One-third (33%) of participants in our predictive analytics benchmark research use it.

The company provides a very broad technology stack including information management, business intelligence, and many types of analytics and visualization. In addition, SAS offers domain-specific applications built on top of these capabilities. A quick count on the products and solutions page on its website shows hundreds of entries, and SAS executives at the event asserted that the company will generate more than 100 releases this year. So one challenge for customers, as with any other large vendor, is navigating through this maze to find something that suits their needs. Also a vendor with a large portfolio is generally not as nimble as one with fewer products. On the other hand a large vendor can more easily manage the interdependencies between products for its customers. That is, if an organization licenses a variety of products from multiple vendors it often falls to the buyer to keep different versions from different vendors in synch.

At this year’s event, big data was much less prominent on the agenda than in the past. Over the last several years SAS has made significant investments in big data, supporting Hadoop and in-memory processing to create a scalable, high-performance infrastructure. This year it focused on end-user tools and prebuilt applications for working with data and analytics. In particular, SAS presenters identified three areas of focus in its technology investments: analytics, data management and visualization.

My colleague Mark Smith has written about the importance of visual discovery. SAS delivers visualization capabilities through its Visual Analytics product line, in which it continues to invest. A speaker claimed that more than 14,000 servers were licensed to run Visual Analytics as of 2015, up from 8,400 in 2014. SAS will be combining the capabilities of Visual Explorer and Visual Designer to create a more unified user experience. The company also is introducing visual data preparation features that enable users to explore and profile data as part of the data integration and transformation process.

No analysis should overlook SAS’s core competency of analytics. I was impressed with its demonstrations of automated evaluation and selection of different predictive analytics algorithms as part of its visualization capabilities. Visual Analytics offers a modern, intuitive user interface for analyzing big data set, but it has only limited collaboration capabilities. Our big data analytics benchmark research finds more than three in four respondents (78%) consider collaboration as important or very important. SAS will need to make further investments to support collaboration.

SAS continues to advance another product, Visual Investigator, which it plans to bring to market more broadly in 2016. Announced last year as part of the Security Intelligence products, it is targeted at what SAS calls the “intelligence analyst,” a role between business analyst and data scientist. This tool has great potential as a standalone product as it combines critical components of tasks, activities, cases, and taking action that have broad appeal across all analytic roles and beyond fraud and security investigations.

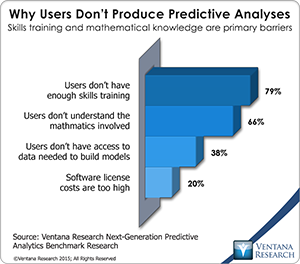

At the event, several analysts questioned SAS executives about the impact of open source systems on the company. This was a hot topic generating much discussion. Executives acknowledged that the company has lost ground to open source systems in the educational market and in response has reinvigorated its efforts there. The SAS University Edition is available for download and on Amazon Web Services. It is also available in a cloud-based offering called SAS On Demand for Academics. Dozens of universities that offer masters of analytics programs are working with SAS to help address the shortage of skilled analytics resources. Our Next Generation Predictive Analytics research shows that lack of skills training and knowledge of the mathematics involved in predictive analytics are significant obstacles to users producing their own analyses, cited by 79% and 66% of participants respectively. It is wise for SAS to invest in supporting these programs. If your organization wants to hire or train additional resources, these programs may be a valuable resource.

there. The SAS University Edition is available for download and on Amazon Web Services. It is also available in a cloud-based offering called SAS On Demand for Academics. Dozens of universities that offer masters of analytics programs are working with SAS to help address the shortage of skilled analytics resources. Our Next Generation Predictive Analytics research shows that lack of skills training and knowledge of the mathematics involved in predictive analytics are significant obstacles to users producing their own analyses, cited by 79% and 66% of participants respectively. It is wise for SAS to invest in supporting these programs. If your organization wants to hire or train additional resources, these programs may be a valuable resource.

On the technology front, executives pointed out that SAS has embraced open source systems, with support for Linux, Hadoop and the Python and Lua programming languages. However, it does not plan to support R, which is used by more than half (58%) of participants in our predictive analytics research . The company also plans to introduce a set of open application programming interfaces (APIs) to encourage more developers to work with SAS and create a marketplace of third-party products. The key will be whether the collection of these efforts makes a significant impact on the developer community, which is where open source tools often gain their foothold in organizations. At a minimum I expect SAS will need to offer a “freemium” version of products if it really wants to win over the development community.

This event provides a valuable window into SAS’s performance and strategy. The company has proven its staying power and ability to be a relatively fast follower of industry trends to remain competitive in the constantly evolving business intelligence and analytics landscape. For organizations that consider expanding their use of analytics, I recommend placing SAS on the list of vendors they evaluate.

Regards,

David Menninger

SVP & Research Director