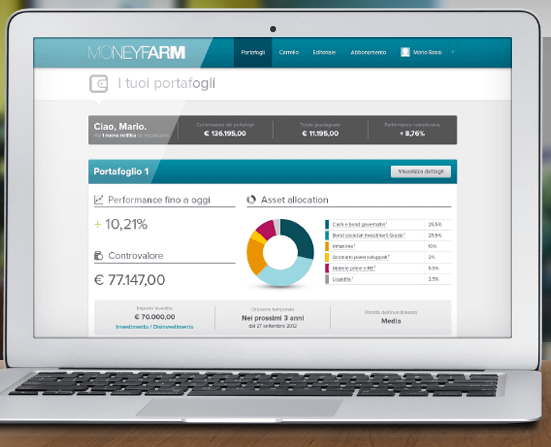

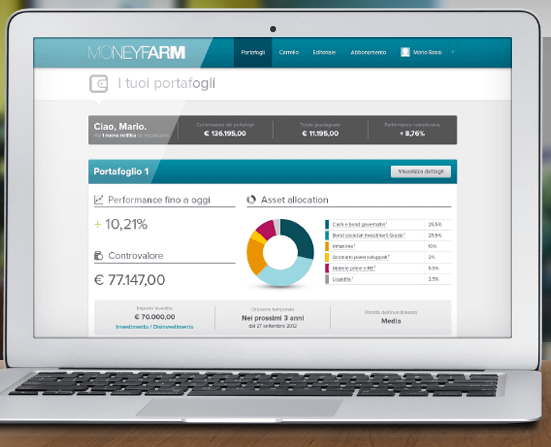

I recently caught up with Andrea Scarso, co-founder and COO of MoneyFarm. MoneyFarm is a startup whose target is to modernize and democratize the European panorama of retail investment services, leveraging the opportunities offered by the web and by process automation. Andrea designed the main decisioning processes.

What’s your background, how did you come to be working in analytics?

I’m a computer scientist, with a strong and lasting interest in machine learning technique. After some experience as a consultant at the beginning of the Internet, I worked for many years at SAS, leading the delivery of business analytic projects, especially for banks and financial services.

During this experience I observed a growing trend in which the application of analytics moved from batch and offline scenarios, where the model’s outcomes were used weeks or months later, toward real-time or “operational” scenarios, where the results are immediately applied.

There are many examples of this phenomenon: from classical scoring models in the credit area to next best action in marketing, from niche marketplace optimization techniques to fraud or money laundering alerting. I witnessed the emphasis move toward the application of the models to a single and immediate decision. This trend led me to decision management.

What are the primary kinds of analytics you build at the moment?

Today I’m focused on the automatic processes that enable MoneyFarm to recommend an investment portfolio more suitable for each customer. Many elements contribute to this decision, for example a psychometric model that estimates customer’s risk propensity, the financial expertise elicited from my partners, and the legal constraints of the MiFID guidelines.

The integration into the business processes of various themes related to compliance represents another significant area of my current activity.

In the near future I hope to be able to immerse myself in the customization of the experience of our platform’s users according to their profile and cognitive preferences.

In your experience what are some of the top challenges for analytic professionals in terms of maximizing the business impact of what they do?

Sometimes I observe too much abstraction in model development. The improvement of the chosen metric becomes an objective by itself, and the only one. On the one hand this drive toward model improvement permits the evolution of analytic techniques and knowledge. On the other, though, I think that in a business setting it is more important to develop, in a reasonable time, a model good enough to be immediately applied, rather than spend weeks to follow a diminishing marginal utility. A good model that quickly demonstrates its benefits has many opportunities to be improved through subsequent iterations. An optimal model that is never production-tested will surely be abandoned. Many examples, from the Netflix competition to my personal experience confirm this.

Another common risk is that the professional developing the model loses sight of (or ignores from the beginning) the business objective of the model itself, the final benefit being pursued and how this objective fits into the processes of the organization. A lack of awareness on this point drastically reduces the opportunities for having an impact on the business.

What have you found that helps meet these challenges? How have you evolved your approach to analytics to maximize the business impact of what you do?

The best way to overcome these challenges is to strictly tie the analytic development to the decisions taken in the organization. Doing so consistently means there is a specific and tangible link between everyday work and the analytics model’s final target. The analyst gets out from their abstract mindset and recognizes the specific consequences of her effort.

I have observed that establishing this link is especially easy and natural in startup enterprises, whose business model frequently revolves around analytic-enabled decisions.

To recommend a movie or an investment portfolio, to optimize a set of matchmaking suggestions or a price, to evaluate the eligibility for a loan or to discover a fraud. In each case the starting point is a specific question to which the whole system must provide an answer. The model should be enabling that answer.

How, specifically, do you develop requirements for analytic projects?

In my opinion, it is paramount to start from the single and specific decision needed. Then, with a top-down process, to analyze its component elements: hard data, background knowledge and constraints, expected outcomes from models.

I have recently found the Decision Modeling technique and it appears a clear and comprehensive tool to address this.

This process is not always strictly top-down. Sometimes investigating a requirement leads you to re-evaluate the structure of a preceding decision, in a bottom-up and iterative way. In MoneyFarm for example, the need to integrate MiFID’s legal constraints (a Knowledge Source using the Decision Modeling terminology) had a significant impact on the interplay of different decisions.

Moreover, my personal approach, whenever it is possible, also encompasses the consideration of another level: the process level, in which the decisions are set.

So the logical chain should be: Process -> Decisions -> Analytics, always with a pragmatic eye. This approach offers the best opportunities to impact usefully on the business.

There’s a growing interest in rigorously modeling decisions as part of specifying the requirements for an analytic project. How do you see this approach adding value for analytics professionals?

I think that modeling the decisions as part of the requirements should be an obvious and essential step in any analytic project. It increases awareness and avoids the risk of sterile “academic” models. It offers the best opportunity to contribute to positive outcomes beyond traditional analytic modeling roles and fully integrates the analytics professional into the project team, for her greater satisfaction.

Anything else you would like to share?

Never before have analytic themes been center stage as they are today. Analytics have huge potential to transform entire industries. Everybody is talking about big data and whole business areas are undergoing disruption and change. It is an extremely positive moment for analytics professionals. We must never forget, however, our social responsibility for how the technologies are applied, always seeking the right balance between their potential and respect of human values and rights.

Last question – what advice would you give analytic professionals to help them maximize the value they create for their organization?

In addition to the previous points, I think it is useful to continuously extend one’s own interest into new areas, both technical and business, as this increases opportunities for cross-fertilization, one of the best drivers of innovation.

For more on Andrea’s work check out moneyfarm.com and follow Andrea on twitter @andreaesseci. For more on decision modeling for analytic projects, check out our white paper.