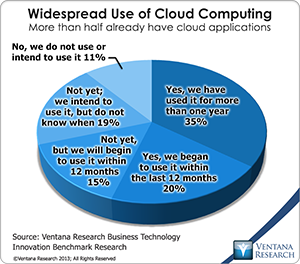

Convergence is the Microsoft Dynamics business software user group’s meeting. Dynamics’ core applications are mainly in the accounting and ERP category, descendants of products Microsoft acquired: Great Plains (now GP), Solomon (SL), Navision (NAV) and Damgaard’s Axapta (AX), to which Microsoft has added its own CRM application. It has been more than a decade since the acquisitions of Great Plains (which itself had already purchased Solomon Software), and Navision, Damgaard and the software applications family has evolved steadily if slowly since then. More recently, Microsoft has added cloud services that simplify and improve the connection between remote users and the on-premises core systems, as well as integration with Office365. Despite being one of the top five ERP software vendors with sales of about $1 billion, Microsoft faces several business and competitive challenges. It is selling into a fully saturated market for accounting and ERP software designed for midsize companies and divisions of larger corporations that have their own systems. Functional innovation in the core applications is difficult in this mature category where the essential functions long ago became commodities. Moreover, from small businesses on up, most companies already have financial systems in place and usually are reluctant to change them until it’s absolutely necessary. The strategic issue confronting Microsoft and other accounting ERP  software vendors is how to differentiate beyond core functionality in order to win sales, keep customers on maintenance and – even better – capture additional share of wallet through incremental sales of complementary software and services. Adding to the difficulty is the seismic shift taking place in the accounting ERP software market as companies increasingly choose to deploy this software in the cloud, where companies such as FinancialForce, Intacct, NetSuite, Plex and Workday, among others, are growing rapidly. Our research shows that more than half of companies are using cloud computing, and more intend to. An important segment of the ERP market is companies outgrowing entry-level accounting packages or replacing on-premises software. The costs of an on-premises system for a midsize business can be daunting, so the cloud can offer more functional and useful systems that are easier to manage and less risky to commit to. To address its strategic challenge, Microsoft insists that it’s not just selling ERP software – its marketing message is that it is providing tools to run businesses better. So while ERP is the core technology for record-keeping and process management, the theme throughout the Convergence user conference was using the full range of available software to enable companies to grow their business, manage more intelligently and perform more efficiently. Microsoft CRM, the Web-based sales, marketing and social application that is a core part of Dynamics, was front and center in the opening day keynote. Since most people are trained and comfortable in Microsoft Excel and Word, Microsoft has been increasing integration of the Dynamics business applications with its Office suite and in particular its Web-based Office 365. The integration of Office 365 into the suite has made it possible for Microsoft to improve productivity by melding Excel spreadsheets into processes to give users the efficiency and convenience of working with a familiar tool while providing sufficient controls to ensure accuracy and auditability. For instance, it’s now possible for an accountant to create a list of journal entries in a spreadsheet and use that spreadsheet to automate the process of posting them into the system. One consistent theme across the Dynamics family now is a roadmap with more frequent releases. Along with this, Microsoft is promising to make upgrades far easier to implement. Cloud ERP vendors stress the ease of their upgrades because they do all of that work. With almost all of the essential functionality already in place in the four core ERP packages that comprise Dynamics, product enhancements usually come down to nice-to-have features. For instance, the latest release of GP adds capabilities that simplify bank account reconciliations, allow companies to make adjustments to already closed ledgers based on subsequent auditor recommendations, to manage vendor IDs and to maintain multiple types of fixed-asset ID numbers so that those for, say, computer equipment are visibly different from ID numbers for plants and equipment or vehicles. They’re hardly earth-shaking but highly appreciated by those who do the work. However, one new capability that was noteworthy is the ability for a company to do a one-click backup to store its accounting ERP data in the cloud-based Azure storage infrastructure. Online backup addresses a key disaster vulnerability for on-premises systems because in practice the backups are rarely stored in a physically separate location. Moreover, not all companies are backing up their data daily so a one-click routine makes it simple enough for anyone to do. Microsoft also plans to include a new applications and service framework (currently called Project Siena) in the upcoming release 3 of AX to make it easier for business users to create relatively simple mobile apps without having to do any coding. This is likely the blueprint for all future releases of Dynamics; it facilitates the creation of smartphone and tablet apps that coordinate and monitor a relatively short set of steps to, for instance, push or pull a limited set of data to and from individuals. If, as Microsoft claims, it will require only Excel and PowerPoint skills to quickly create useful mobile applications, that could be an important product differentiator. Microsoft’s market position will continue to be challenged by the cloud ERP vendors as these companies build their installed bases on the advantages of subscription-based services over on-premises deployment as well as other functional advantages. For example, in addition to full and easy integration with Salesforce, FinancialForce has a set of professional services automation (PSA) components (such as integrating project management, and time and cost tracking with billing), making it an attractive option to the large number of midsize professional services companies, as I recently noted. Workday, which my colleague Stephan Millard reviewed, is especially appealing as an ERP system for industries that must manage large workforces. It’s clear that cloud software vendors in this market have been growing faster than on-premises ones. In 2013, Dynamics revenues increased 10 percent, according to Microsoft, while NetSuite’s revenues were up 34 percent and Workday’s doubled. Still, Microsoft’s gain was greater than its most comparable rivals, Sage Software, which reported a 4 percent rise on the top line, and Infor, which had flat sales.

software vendors is how to differentiate beyond core functionality in order to win sales, keep customers on maintenance and – even better – capture additional share of wallet through incremental sales of complementary software and services. Adding to the difficulty is the seismic shift taking place in the accounting ERP software market as companies increasingly choose to deploy this software in the cloud, where companies such as FinancialForce, Intacct, NetSuite, Plex and Workday, among others, are growing rapidly. Our research shows that more than half of companies are using cloud computing, and more intend to. An important segment of the ERP market is companies outgrowing entry-level accounting packages or replacing on-premises software. The costs of an on-premises system for a midsize business can be daunting, so the cloud can offer more functional and useful systems that are easier to manage and less risky to commit to. To address its strategic challenge, Microsoft insists that it’s not just selling ERP software – its marketing message is that it is providing tools to run businesses better. So while ERP is the core technology for record-keeping and process management, the theme throughout the Convergence user conference was using the full range of available software to enable companies to grow their business, manage more intelligently and perform more efficiently. Microsoft CRM, the Web-based sales, marketing and social application that is a core part of Dynamics, was front and center in the opening day keynote. Since most people are trained and comfortable in Microsoft Excel and Word, Microsoft has been increasing integration of the Dynamics business applications with its Office suite and in particular its Web-based Office 365. The integration of Office 365 into the suite has made it possible for Microsoft to improve productivity by melding Excel spreadsheets into processes to give users the efficiency and convenience of working with a familiar tool while providing sufficient controls to ensure accuracy and auditability. For instance, it’s now possible for an accountant to create a list of journal entries in a spreadsheet and use that spreadsheet to automate the process of posting them into the system. One consistent theme across the Dynamics family now is a roadmap with more frequent releases. Along with this, Microsoft is promising to make upgrades far easier to implement. Cloud ERP vendors stress the ease of their upgrades because they do all of that work. With almost all of the essential functionality already in place in the four core ERP packages that comprise Dynamics, product enhancements usually come down to nice-to-have features. For instance, the latest release of GP adds capabilities that simplify bank account reconciliations, allow companies to make adjustments to already closed ledgers based on subsequent auditor recommendations, to manage vendor IDs and to maintain multiple types of fixed-asset ID numbers so that those for, say, computer equipment are visibly different from ID numbers for plants and equipment or vehicles. They’re hardly earth-shaking but highly appreciated by those who do the work. However, one new capability that was noteworthy is the ability for a company to do a one-click backup to store its accounting ERP data in the cloud-based Azure storage infrastructure. Online backup addresses a key disaster vulnerability for on-premises systems because in practice the backups are rarely stored in a physically separate location. Moreover, not all companies are backing up their data daily so a one-click routine makes it simple enough for anyone to do. Microsoft also plans to include a new applications and service framework (currently called Project Siena) in the upcoming release 3 of AX to make it easier for business users to create relatively simple mobile apps without having to do any coding. This is likely the blueprint for all future releases of Dynamics; it facilitates the creation of smartphone and tablet apps that coordinate and monitor a relatively short set of steps to, for instance, push or pull a limited set of data to and from individuals. If, as Microsoft claims, it will require only Excel and PowerPoint skills to quickly create useful mobile applications, that could be an important product differentiator. Microsoft’s market position will continue to be challenged by the cloud ERP vendors as these companies build their installed bases on the advantages of subscription-based services over on-premises deployment as well as other functional advantages. For example, in addition to full and easy integration with Salesforce, FinancialForce has a set of professional services automation (PSA) components (such as integrating project management, and time and cost tracking with billing), making it an attractive option to the large number of midsize professional services companies, as I recently noted. Workday, which my colleague Stephan Millard reviewed, is especially appealing as an ERP system for industries that must manage large workforces. It’s clear that cloud software vendors in this market have been growing faster than on-premises ones. In 2013, Dynamics revenues increased 10 percent, according to Microsoft, while NetSuite’s revenues were up 34 percent and Workday’s doubled. Still, Microsoft’s gain was greater than its most comparable rivals, Sage Software, which reported a 4 percent rise on the top line, and Infor, which had flat sales.  Microsoft has no direct sales channel for Dynamics, and its resellers have been slow to adopt the cloud. But market forces are likely to change this, so in the longer term, Microsoft may evolve into a hybrid cloud ERP vendor, offering customers multiple options on how to deploy its software. For companies of all sizes, deploying software in the cloud offers potential advantages, chiefly lower costs and increased efficiency. To begin addressing the need to have more of a cloud presence, the upcoming release of Dynamics AX will make it easier for resellers to deploy the software as a single-tenant instance using a Windows Azure-hosted service. It’s likely that the other Dynamics applications will follow shortly. The single-tenant approaches addresses many but not all of the issues in on-premises vs. multitenant cloud-based systems. For instance, companies do not have to invest in hardware, are able to scale computing capacity as needed and do not have to hire staff to manage and maintain IT assets. Yet the direct cost of ownership may be higher than for multitenant because that deployment method can offer economies of scale relative to a private cloud. Still, customers will have more options as to how the application is configured, and for some a private cloud may be the better one. Like all user group meetings, this year’s Convergence had many success stories. These demonstrated intelligent use of enterprise software enabling midsize companies to be more competitive with larger rivals that have more resources while improving efficiency by automating more business processes that are now done manually. Companies that are confronting the limits of their aging accounting and ERP systems must think past the limits of their current system and understand what’s possible today. Midsize companies have more choices – and more affordable choices – than ever in choosing an ERP vendor. They should consider Microsoft Dynamics in selecting new software.

Microsoft has no direct sales channel for Dynamics, and its resellers have been slow to adopt the cloud. But market forces are likely to change this, so in the longer term, Microsoft may evolve into a hybrid cloud ERP vendor, offering customers multiple options on how to deploy its software. For companies of all sizes, deploying software in the cloud offers potential advantages, chiefly lower costs and increased efficiency. To begin addressing the need to have more of a cloud presence, the upcoming release of Dynamics AX will make it easier for resellers to deploy the software as a single-tenant instance using a Windows Azure-hosted service. It’s likely that the other Dynamics applications will follow shortly. The single-tenant approaches addresses many but not all of the issues in on-premises vs. multitenant cloud-based systems. For instance, companies do not have to invest in hardware, are able to scale computing capacity as needed and do not have to hire staff to manage and maintain IT assets. Yet the direct cost of ownership may be higher than for multitenant because that deployment method can offer economies of scale relative to a private cloud. Still, customers will have more options as to how the application is configured, and for some a private cloud may be the better one. Like all user group meetings, this year’s Convergence had many success stories. These demonstrated intelligent use of enterprise software enabling midsize companies to be more competitive with larger rivals that have more resources while improving efficiency by automating more business processes that are now done manually. Companies that are confronting the limits of their aging accounting and ERP systems must think past the limits of their current system and understand what’s possible today. Midsize companies have more choices – and more affordable choices – than ever in choosing an ERP vendor. They should consider Microsoft Dynamics in selecting new software.