The enterprise resource planning (ERP) system is a pillar of nearly every company’s record-keeping and management of business processes. It is essential to the smooth functioning of the accounting and finance functions. In manufacturing and distribution, ERP also can help plan and manage inventory and logistics.

also can help plan and manage inventory and logistics.

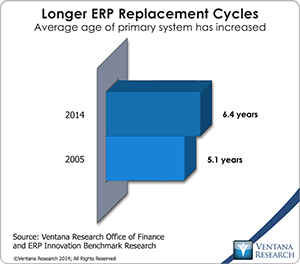

The enterprise resource planning (ERP) system is a pillar of nearly every company’s record-keeping and management of business processes. It is essential to the smooth functioning of the accounting and finance functions. In manufacturing and distribution, ERP also can help plan and manage inventory and logistics. Some companies use it to handle human resources functions such as tracking employees, payroll and related costs. Yet despite their ubiquity, ERP systems have evolved little since their introduction a quarter of a century ago. The technologies shaping their design, functions and features had been largely unchanged. As a measure of this stability, our Office of Finance benchmark research found that in 2014 companies on average were keeping their ERP systems one year longer than they had in 2005.

also can help plan and manage inventory and logistics. Some companies use it to handle human resources functions such as tracking employees, payroll and related costs. Yet despite their ubiquity, ERP systems have evolved little since their introduction a quarter of a century ago. The technologies shaping their design, functions and features had been largely unchanged. As a measure of this stability, our Office of Finance benchmark research found that in 2014 companies on average were keeping their ERP systems one year longer than they had in 2005.

Recently, however, we have seen signs of change. The evolutionary pace of technologies that shape the design of ERP systems has been accelerating over the last couple of years. In addition to the cloud there are in-memory computing; analytics and planning integrated into transaction processing systems; mobility; in-context collaboration; and more intuitive user interface design. While ERP vendors generally acknowledge these innovative technologies, our research and conversations with ERP software users indicates that they are just beginning to make their way into product design and thus far have had little impact on the market.

Then there’s the buzz about “consumerized” ERP and other business applications – fresher designs that look and interact with the user like consumer software such as mobile apps on smartphones. Established screen layouts and process designs often are legacies of technology limitations that no longer exist. In addition, increasing numbers of users don’t want or need to interact with their business applications through desktop or laptop computers. Support for mobile devices has become common, but gestures and other new user interface conventions that expand and improve the ways in which users can interact with their system on other devices such as laptops are a likely future capability, especially as touch screens become common on all devices. Voice interaction, a potentially powerful advance, is still in its infancy. Notifications and approvals increasingly will be accessible from wearable devices and mobile technology watches. Since all business is collaborative, we expect in-context collaboration capabilities to evolve rapidly to improve productivity in every business function, enabling greater responsiveness to customers and speeding the completion of core processes.

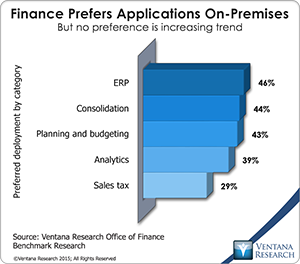

Despite the growing popularity of cloud-based systems, the issue of where ERP systems should reside is not settled. The cloud is likely to account for a substantial portion of the market. But it’s useful to remember that even though our research shows that resistance to cloud-based ERP is ebbing and that cloud ERP vendors’ sales have been growing faster than on-premises vendors, the cloud still has a small share of the installed base. A significant challenge for vendors of multitenant software as a service (SaaS) is that the key benefit is also a constraint. Because buyers configure the features and capabilities rather than customizing the core code base, implementations can be faster and less expensive. In issuing new releases or modifications to the software, the vendor makes those changes to the code that everyone is running, either immediately or after a grace period. This requires far less work for the customer than having in-house IT personnel update on-premises versions and patches.

Despite the growing popularity of cloud-based systems, the issue of where ERP systems should reside is not settled. The cloud is likely to account for a substantial portion of the market. But it’s useful to remember that even though our research shows that resistance to cloud-based ERP is ebbing and that cloud ERP vendors’ sales have been growing faster than on-premises vendors, the cloud still has a small share of the installed base. A significant challenge for vendors of multitenant software as a service (SaaS) is that the key benefit is also a constraint. Because buyers configure the features and capabilities rather than customizing the core code base, implementations can be faster and less expensive. In issuing new releases or modifications to the software, the vendor makes those changes to the code that everyone is running, either immediately or after a grace period. This requires far less work for the customer than having in-house IT personnel update on-premises versions and patches.

The constraint, however, is that the software cannot be customized. As I’ve noted, the primary barrier to making ERP software more configurable is the inherent complexity of the business processes the systems manage. ERP systems must be able to handle the specific needs of users, which can differ considerably from one industry to another and even between specific micro-verticals that might span multiple business units in a range of industries, locations and jurisdictions. If the software cannot be configured to meet the customer’s feature, functionality and process requirements, and if the customer cannot adapt its operations to these limitations, a cloud-based product isn’t a feasible solution. Many manufacturing and product-centric businesses have found it difficult because their requirements are often too specific and diverse. Unlike with on-premises software, there is no option to customize multitenant SaaS offerings to the needs of a single customer unless the vendor is willing to make the necessary changes to the core code base and the timing of those changes is acceptable to the customer.

Some new supporting technologies will enhance the business value of ERP applications as companies adapt their business processes to take advantage of new capabilities. For instance, in-memory computing platforms and big data likely will change how organizations – especially in finance and accounting – work with computers. Processes can be executed faster, and transaction processing systems can include analytic capabilities. Increasingly, ERP vendors will incorporate performance measurement and monitoring as well as building optimization functionality into business processes.

In-memory processing promises a much more interactive experience while big data management will underpin the sophisticated use of analytics to develop actionable insights, alerts and performance measurement from the masses of data accumulating in ERP systems. Mobile technologies, ubiquitous among the new generation in the form of smartphones and tablets, will drive demand for the availability of on-the-fly analytics and dynamic planning to enhance forward visibility and deepen situational awareness to guide transaction processes. Similarly, the emerging Internet of Things (the network of physical objects embedded with electronics, software, sensors and connectivity to enable objects to exchange data with other connected devices) extends the possibilities for expanding the ERP system’s capabilities in automating the handling of physical assets and the associated record-keeping, analysis and process management.

It’s not just technology. Users of ERP systems are changing, and this is shaping ERP system design. Fresher screen designs and reduced screen clutter are some of the initial improvements. The demographic shift taking place in the ranks of senior executives and managers, from the baby boom generation to those who grew up with computer technology, is creating demand for software that is both more capable and more usable. Soon, to be competitive, ERP systems will have to deliver three major improvements: lower total cost of ownership, a better user experience and greater flexibility and agility.

Despite these growing demands concerning how it works, though, buyers’ expectations for what ERP software should do haven’t changed much so far. But change almost certainly will accelerate over the next five years. Companies’ selection processes are driven largely by their experience with the last generation of products and the pain points they experienced. They view these systems as notoriously time-consuming and expensive to set up, maintain and modify. Indeed, in our ERP research only 21 percent of larger companies said that implementing new capabilities in ERP systems is easy or very easy while one-third characterized it as difficult.

Unlike in the shift from mainframe financial and manufacturing management applications to client/server ERP, this time the larger incumbents will be less vulnerable to disruption. One important reason is that their large maintenance revenue streams provide greater development firepower compared to upstarts. Nonetheless, all vendors will be challenged in the market if they fail to evolve to meet the expectations of a new generation of executives and users. Smaller ERP vendors, whether mainly on-premises or cloud-based, will need to invest in enhancing their software at a faster pace than has been necessary over the past decade.

The ERP software market is poised for the first significant transformation since the 1990s and is the rationale for our new benchmark research we will conduct on this topic. A combination of new technologies and changing user demands will drive changes in system design. The result will be systems that are easier to use and easier to modify to suit the needs of customers. A new generation of users will demand software that makes doing their jobs easier, supports their ability to collaborate and work with the system anytime, anywhere. Change is coming slowly, but the landscape of ERP a decade from now will be very different.