I recently completed two closely related benchmark research reports, on next-generation customer engagement and next-generation customer analytics.

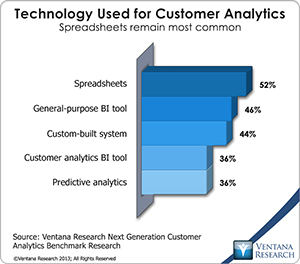

I recently completed two closely related benchmark research reports, on next-generation customer engagement and next-generation customer analytics. The research on customer engagement  shows that companies on average engage with customers through seven or eight communication channels and that almost every business unit except IT engages with customers. To provide customers with personalized, in-context and consistent experiences across these channels, companies need an up-to-date, complete view of their customers that gives those who interact with them the information they need to decide how to respond. However, the customer analytics research shows that the majority of companies don’t have access to such information and analysis. The most common analytics tool for more than half of companies is spreadsheets in 52 percent of organizations. Although spreadsheets meet individual users’ needs for ad-hoc analysis, they are inadequate for enterprise processes such as customer analytics. Almost three-fifths (57%) of companies in the research said that using spreadsheets makes it difficult to produce accurate and timely customer analysis.

shows that companies on average engage with customers through seven or eight communication channels and that almost every business unit except IT engages with customers. To provide customers with personalized, in-context and consistent experiences across these channels, companies need an up-to-date, complete view of their customers that gives those who interact with them the information they need to decide how to respond. However, the customer analytics research shows that the majority of companies don’t have access to such information and analysis. The most common analytics tool for more than half of companies is spreadsheets in 52 percent of organizations. Although spreadsheets meet individual users’ needs for ad-hoc analysis, they are inadequate for enterprise processes such as customer analytics. Almost three-fifths (57%) of companies in the research said that using spreadsheets makes it difficult to produce accurate and timely customer analysis.

We have identified key steps in any analytics process: setup and maintenance of the data to be analyzed, preparation of the data, analysis of the data, interpretation of the results and action. As my colleague Robert Kugel has often noted, most spreadsheet users are self-taught, and setting up and maintaining spreadsheets can be time-consuming tasks. Those with limited skills may stick to the basics and so miss out on more complex analysis. Indeed, my benchmark research finds that only 15 percent of companies said their employees have excellent analytics skills, and more than one-third (35%) of business users said they don’t get enough support from IT in using customer analytics.

In addition, companies are now generating enormous volumes of customer data, much of it unstructured, including call recordings, text messages, chat and Web scripts, CRM notes and social media posts. For spreadsheet users, extracting insights from so much various data requires considerable amounts of manual effort. For example, someone must listen to calls to extract customer sentiment from call recordings and then input the content. In addition, given the sheer volume of these types of data, many companies cannot process it all and therefore can’t produce a complete view.

Because of the lack of skills and the limited visualization capabilities of spreadsheets, most users settle for simple 2-D charts such as graphs, pie charts and line diagrams. Our research shows that almost three-quarters (72%) of companies are content to limit outputs to such charts and therefore potentially miss out on insights that could be uncovered through advanced forms of visualization. As many people before me have said, there is little benefit to producing information and analysis if you don’t use it to take action. Spreadsheets are limited also in capabilities to share outputs, and so most companies put that data into PowerPoint slides and share the results through email. Under such circumstances, it is likely that not everyone is using the same customer analysis, which in turn raises the likelihood of employees making decisions based on inconsistent information.

However, if spreadsheets are not the answer, what is? Our benchmark research shows that one in four (26%) companies have adopted a dedicated customer analytics tool and that those businesses have achieved on average nearly six benefits. The chief benefit is improvements in the customer experience, which 55 percent have realized. This is closely followed by seven other benefits, achieved by an almost equal number of companies: better analysis across a range of business needs (52%), better alignment across business units (51%), better sharing and communication across business units (49%), improved productivity (49%), improved efficiency of business processes (47%), faster responses to opportunities (47%) and enhanced competitive advantage (47%). All of these benefits are compelling reasons to change, but our research doesn’t show this happening: Only about one in three (29%) participants said they intend to change in the next 12 months.

However, if spreadsheets are not the answer, what is? Our benchmark research shows that one in four (26%) companies have adopted a dedicated customer analytics tool and that those businesses have achieved on average nearly six benefits. The chief benefit is improvements in the customer experience, which 55 percent have realized. This is closely followed by seven other benefits, achieved by an almost equal number of companies: better analysis across a range of business needs (52%), better alignment across business units (51%), better sharing and communication across business units (49%), improved productivity (49%), improved efficiency of business processes (47%), faster responses to opportunities (47%) and enhanced competitive advantage (47%). All of these benefits are compelling reasons to change, but our research doesn’t show this happening: Only about one in three (29%) participants said they intend to change in the next 12 months.

This of course begs the question, Why not? The benchmark research finds the answer in a lack of focus on producing a compelling business case for change. It seems companies’ primary concern is the presentation of the business case, not the potential value of investing in customer analytics, finding the budget for such an investment and gaining executive sponsorship. Given that companies see spreadsheets as “free,” producing a case for spending money is not a priority for most. However, customers are the lifeblood of all businesses, so having a complete view of them is essential to marketing, sales, customer service and financial success. As such, I urge companies to look at the benefits others have gained using dedicated customer analytics tools and use them to build a case for change.