Our latest benchmark research on sales applications and technology reveals th

Our latest benchmark research on sales applications and technology reveals th

Our latest benchmark research on sales applications and technology reveals three trends sales organizations see as critical to improving their operations and performance: mobile technology like smartphones and tablets, collaborative capabilities and business analytics applied to sales. At the same time many sales processes are becoming easier to use, including compensation, forecasting and quota and territory management. To take advantage of these advancements sales management has to establish priorities and better understand how they can help maximize the time focused on selling.

Our latest benchmark research on sales applications and technology reveals three trends sales organizations see as critical to improving their operations and performance: mobile technology like smartphones and tablets, collaborative capabilities and business analytics applied to sales. At the same time many sales processes are becoming easier to use, including compensation, forecasting and quota and territory management. To take advantage of these advancements sales management has to establish priorities and better understand how they can help maximize the time focused on selling.

Our research found that while many sales organizations have made steps forward, most are still lagging when it comes to their overall sales processes. Only 14 percent of sales organizations are operating at peak levels of efficiency and effectiveness, due to a range of issues across the sales team, its processes and the information, applications and technology, which they need to operate across all levels of the organization. Sales leadership also sometimes fails to understand how technology can help retain sales talent and foster sales activity. While our research found that most organizations agree on the common goals of sales – increasing revenue (72%), improving efficiency of sales (57%) and growing business in net new customers (56%) – more than two-thirds still use spreadsheets universally or regularly, though they admit that reliance on spreadsheets makes it difficult to manage sales efficiently.

Our research found that while many sales organizations have made steps forward, most are still lagging when it comes to their overall sales processes. Only 14 percent of sales organizations are operating at peak levels of efficiency and effectiveness, due to a range of issues across the sales team, its processes and the information, applications and technology, which they need to operate across all levels of the organization. Sales leadership also sometimes fails to understand how technology can help retain sales talent and foster sales activity. While our research found that most organizations agree on the common goals of sales – increasing revenue (72%), improving efficiency of sales (57%) and growing business in net new customers (56%) – more than two-thirds still use spreadsheets universally or regularly, though they admit that reliance on spreadsheets makes it difficult to manage sales efficiently.

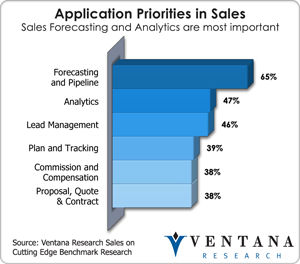

After two decades of sales force automation (SFA) software, more than two-thirds of sales organizations use it now, compared to 42 percent in 2008, and 61 percent are satisfied with the software. Most sales organizations are content with their suppliers, which provides challenges for competitors that focus on converting SFA customers rather than expanding their portfolios of sales applications. Yet more than two-thirds of sales organizations today do not have applications to support a range of sales processes, including channel management, commissions, incentives, objectives, configure-price-quote, proposal, and quota and territory management. Most still use spreadsheets and custom applications for these activities. Our research found sales organizations’ most important priorities to be forecasting, analytics, lead management, planning and tracking, and commissions and compensation, all of which indicate that sales will need tools beyond sales force automation. Integration of these new areas with SFA is critical to leveraging operational resources like accounts and opportunities.

After two decades of sales force automation (SFA) software, more than two-thirds of sales organizations use it now, compared to 42 percent in 2008, and 61 percent are satisfied with the software. Most sales organizations are content with their suppliers, which provides challenges for competitors that focus on converting SFA customers rather than expanding their portfolios of sales applications. Yet more than two-thirds of sales organizations today do not have applications to support a range of sales processes, including channel management, commissions, incentives, objectives, configure-price-quote, proposal, and quota and territory management. Most still use spreadsheets and custom applications for these activities. Our research found sales organizations’ most important priorities to be forecasting, analytics, lead management, planning and tracking, and commissions and compensation, all of which indicate that sales will need tools beyond sales force automation. Integration of these new areas with SFA is critical to leveraging operational resources like accounts and opportunities.

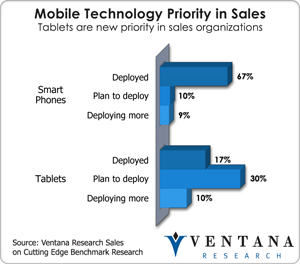

I recently outlined our research agenda for sales to educate the market on the use of technology and best practices. I have been engaged in the sales applications market since the early 90’s and have designed and deployed SFA, and it is a pretty exciting time to be assessing how new mobile technologies can help improve sales. Unfortunately, most sales applications are not ready for use on smartphones and tablets. Quick access to information from smartphones is essential, as sales teams are usually on the go. Our research found that 30 percent of sales organizations are planning to deploy tablets in 2012, and they plan to purchase both Apple and Android tablets; supporting them will require software vendors to build applications that can operate natively or within the Web browser on both platforms.

I recently outlined our research agenda for sales to educate the market on the use of technology and best practices. I have been engaged in the sales applications market since the early 90’s and have designed and deployed SFA, and it is a pretty exciting time to be assessing how new mobile technologies can help improve sales. Unfortunately, most sales applications are not ready for use on smartphones and tablets. Quick access to information from smartphones is essential, as sales teams are usually on the go. Our research found that 30 percent of sales organizations are planning to deploy tablets in 2012, and they plan to purchase both Apple and Android tablets; supporting them will require software vendors to build applications that can operate natively or within the Web browser on both platforms.

Our research and work with sales organizations shows a lot of need for improvement. We recommend that they create a team to classify the improvements needed for each role in the sales management process: managers, operations, analysts and account executives. Each has specific needs that often get overlooked or are expected to be addressing by upgrading the SFA application. Our research found that sales organizations are slowly moving to do what they need to do; one-quarter plan investments evenly across the roles in sales. Across all roles, usability is the number-one evaluation criterion for new technologies in 73 percent of sales organizations, even more critical than functionality, manageability and other criteria that we have defined in our Value Index evaluation and RFP methodology.

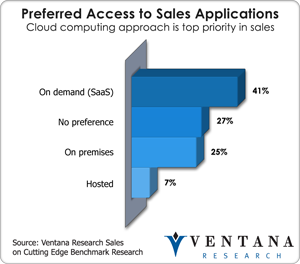

Many organizations (41%) will get new applications primarily through cloud computing and software as a service. Another 27 percent have no deployment preference. This leaves only one-quarter of organizations preferring the on-premises approach, and 7 percent preferring hosted. The days of buying, installing and living with legacy applications for sales are over, as companies turn away from relying on their IT staff to upgrade them.

Many organizations (41%) will get new applications primarily through cloud computing and software as a service. Another 27 percent have no deployment preference. This leaves only one-quarter of organizations preferring the on-premises approach, and 7 percent preferring hosted. The days of buying, installing and living with legacy applications for sales are over, as companies turn away from relying on their IT staff to upgrade them.

Our research confirmed that sales organizations that are most efficient and able to maximize selling time are those that have invested in applications designed for sales. But we found that getting the budget to enhance sales applications will not be easy; it is the largest impediment for organizations, followed by lack of executive sponsorship and an unconvincing business case for investment. The more that sales teams can demonstrate how new software can save time and improve sales effectiveness toward revenue targets, the faster these advances will be adopted. If your organization needs technology help, you might find allies in finance, since they have a vested interest in improved sales performance and revenue; the research shows that one-quarter of finance groups will sponsor and help fund new investments in order to get information on a more timely basis. If you have not been looking at what technology can do to improve sales efficiency and effectiveness, get started and look at what could be a new renaissance in sales applications. In the coming weeks I will be writing in more depth about some of the key tools, from analytics to forecasting, that can help improve sales results and overall business health.

Regards,

Mark Smith – CEO & Chief Research Officer