Despite the surge in interest and sales of modern data discovery tools like SAP BusinessObjects Lumira and SAP BusinessObjects Cloud, corporations are still really, really interested in reporting.

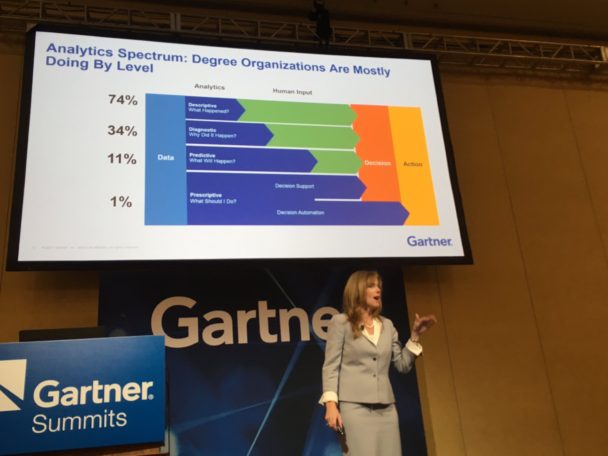

At the recent Gartner Data & Analytics event in Texas, Cindi Howson showed that descriptive analytics remains by far the most common type of analysis that companies do in the real world.

Last year, Gartner redefined the BI and Analytics Platforms Magic Quadrant, relegating traditional self-service and interactive reporting tools that do the bulk of today’s descriptive analytics, like WebIntelligence, to a separate Enterprise-Reporting Based Platforms report — even though the newer tools made up only 25% of the overall market for analytics software.

Last year, Gartner redefined the BI and Analytics Platforms Magic Quadrant, relegating traditional self-service and interactive reporting tools that do the bulk of today’s descriptive analytics, like WebIntelligence, to a separate Enterprise-Reporting Based Platforms report — even though the newer tools made up only 25% of the overall market for analytics software.

Demand for the new tools is increasing rapidly, for good reasons. In particular, they are more agile and so can more easily keep up with ever-changing analytic needs. But in most organizations, there are still plenty of business benefits that can be achieved with traditional enterprise reporting tools.

For example, fresh-food supplier Pret a Manger used WebIntelligence to deliver real-time, actionable information on mobile devices to front-line workers.

For example, fresh-food supplier Pret a Manger used WebIntelligence to deliver real-time, actionable information on mobile devices to front-line workers.

The insights made a huge difference to the way the company was run, even though this investment is no longer considered “analytics” according to Gartner’s latest criteria.

As Donald MacCormick has often pointed out in his blog posts, the reality is that many (most?) people just want easy access to the information they need to do their job.

![]() For example, some of the most powerful computers in the world are used to calculate weather predictions, but most of us are happy to consume all that complexity as a simple symbol that tells us whether to bring an umbrella or not.

For example, some of the most powerful computers in the world are used to calculate weather predictions, but most of us are happy to consume all that complexity as a simple symbol that tells us whether to bring an umbrella or not.

Even if newer solutions can provide the same information in more flexible ways, many organizations have made big investments in traditional interactive reporting and IT-created dashboards over the years and see no big incentive to recreate them all from scratch in newer tools.

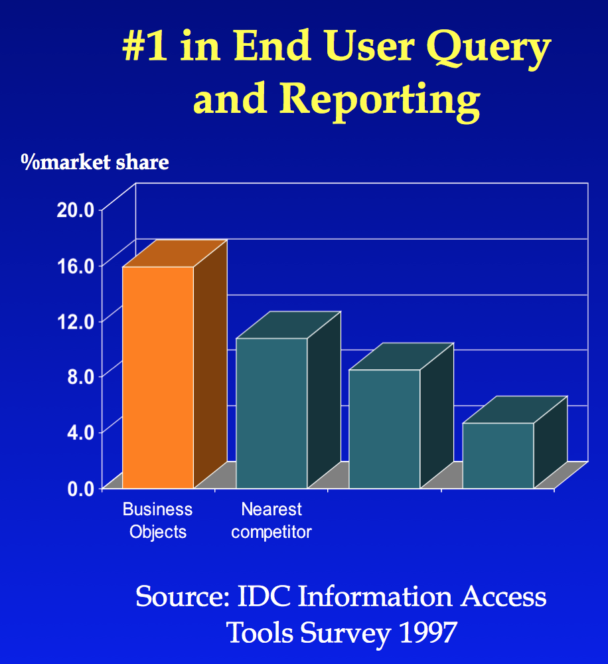

This helps explain the remarkable robustness of the market share held by traditional analytics vendors. For example, I stumbled across this old chart of IDC market share data (3D charts alert!). It shows the market-leading share of SAP BusinessObjects in 1997.

This helps explain the remarkable robustness of the market share held by traditional analytics vendors. For example, I stumbled across this old chart of IDC market share data (3D charts alert!). It shows the market-leading share of SAP BusinessObjects in 1997.

Analytics has been at or near the top of CIO priority lists ever since. Every year, organizations carefully compare the dozens of different analytics products available to them, and invest in the ones that are the best fit for their real-world needs.

IDC eventually renamed the category “Worldwide Query, Reporting, and Analysis” revenue, but SAP / BusinessObjects has now been the number one analytics vendor for over two decades.

For organizations that already have a lot of reports, it makes a lot of sense to continue to invest in vendors that can support their existing infrastructure as well as help them with the transition to compatible modern data discovery and visualization tools.

At next week’s Gartner Data & Analytics event, I’m sure we’ll hear a lot more about the future of BI — but in the meantime, it’s clear that the reporting past is far from dead.