We are seeing an expansion in the demand and expectation for geospatial information across industries. This expansion is particularly evident in mass data — the visual information and models produced by georeferenced imaging and LiDAR. Mass data enables people to answer questions and make decisions about their businesses, assets, and environments. It’s catalyzing demand in both the personal and professional realms.

In the span of just a few years, reliance upon geospatial data has become a routine part of people’s lives. For instance, before going out to a restaurant, a person might use Google Street View to plan the route, find parking or look for other restaurants in the area. As geospatial data becomes more prevalent in their personal lives, users are recognizing its potential in commercial settings as well.

By understanding the demand for geospatial information, geospatial professionals can increase the value of solutions and services they provide to their clients. There are five primary drivers behind the demand growth:

1. Increasing Scope of Geospatial Information

The variety of geospatial data has expanded rapidly in the past decade. It is no longer limited to simple point and feature-based locations and attributes. In addition to imagery and LiDAR point clouds, geospatial data can now include multi-spectral aerial data as well as individual points and features. The tools for collecting data include satellites, crewed and unmanned aircraft systems (UAS), mobile and stationary cameras and scanners, and a broad range of handheld and survey-grade GNSS and optical positioning devices.

The variety of geospatial data also enables users to work to the level of precision needed for a particular application. Geospatial technologies can produce data with accuracies ranging from sub-centimeter to a few meters. This flexibility helps manage costs and improve field productivity, which brings geospatial data to a wider variety of users and applications.

2. Demand for Rapid Decisions

Modern businesses operate on tight schedules and need the ability to make decisions quickly. Decisions rely on accurate data; delays or long turnaround times can affect activities and increase expenses. And schedule and cost pressures often combine to reduce the time available to gather and deliver information.

Additionally, the information to support fast-moving projects and processes often needs frequent updates. Decision makers prefer to use “fresh data” that reflects current conditions. They rely on their organization’s ability to produce information quickly. Streamlined processes for data collection and analysis are essential to providing timely, accurate information.

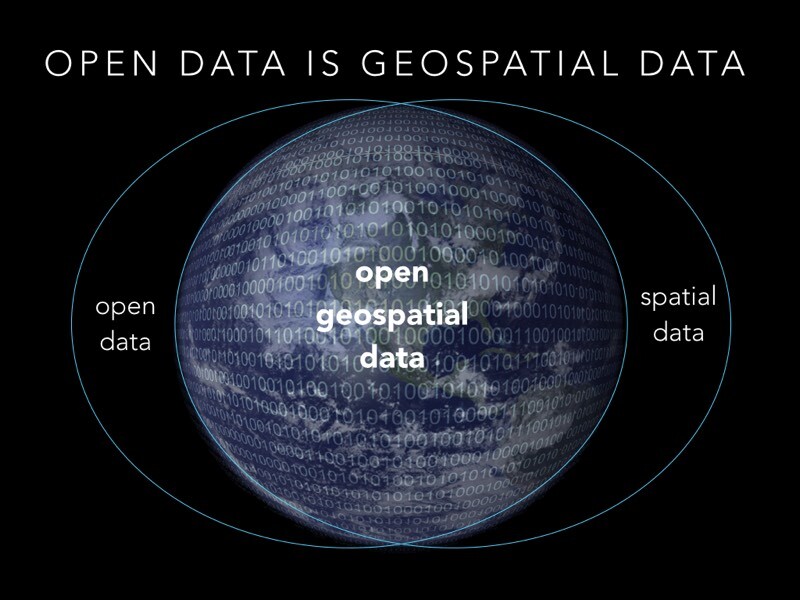

3. Growing Variety of Users Consuming Spatial Data

Business decision processes based on spatial information often extend beyond traditional geospatial professionals. Disciplines such as operations, finance, asset/facility management and construction use information on the location of assets and materials for day-to-day management and planning.

For example, defining a corridor for an electricity transmission line brings together factors in engineering, environment, finance and land use regulations. Working from the same data set, each discipline can extract the information that it needs. Comprehensive geospatial information enables the project team to examine how changes in one factor can affect the others. While they understand the value of the geospatial information they rely on, non-geospatial professionals may not know — or care — how the information comes to their desktops.

4. Multi-Dimensional Models for Visualization and Business Intelligence

Geospatial data has moved far beyond the days of two-dimensional drawings and maps. Information can be produced and visualized to facilitate in-depth analysis and evaluation. Three-dimensional positions and attributes can be developed according to requirements for precision and detail. By combining multiple data sets, it’s possible to develop 4D models that enable users to view conditions over time. This approach provides the ability to detect and measure changes and provides important benefits to applications such as construction, earthwork, agriculture and land administration.

A fifth dimension, cost, also can be included with spatial information. The resulting model enables users to improve efficiency and cost effectiveness for asset deployment. A construction manager can use visualization tools to create a virtual site and examine options for moving equipment and materials during a project. Similarly, landfill operators can use 5D techniques to manage daily operations and ensure optimal long-term utilization of permitted airspace volumes.

5. Collaboration Across Organizations

The fifth driver for geospatial information comes from the need for organizations to work across different user types at multiple locations. Companies are seeking to leverage the value of spatial data throughout their organizations. In addition to providing specialized information for different users, organizations need ways to move and share data while ensuring security and integrity.

For example, a large construction company may operate several simultaneous projects in remote locations from a central office. Functions such as engineering, financial control, and scheduling share spatial information gathered at multiple sites. Cloud-based solutions for data management allow the company to maintain complex data sets and provide access to stakeholders around the globe.

Five Drivers and One Goal

To illustrate the effects of the five drivers, consider a mining company in Australia. The company needs to conduct frequent measurements at its mine sites. It uses a Trimble UX5 HP UAS to capture mass data in the form of aerial imagery. The imagery can be collected at regular intervals and with lower cost than crewed aircraft. (As an added benefit, the UAS can operate without disrupting normal mine operations or sending ground surveyors into hazardous areas.)

The data from the UAS can be used locally or sent hundreds of kilometers to company offices in Perth. There, the images are processed using Inpho UAS Master or Trimble Business Center software to produce 3D models for use in volume computations. Models can be compared over time to provide information on mine construction and material movement. The information is used by mine engineers, production managers and financial and back-office teams. This approach enables the company to operate multiple mines using shared resources to increase productivity and reduce costs.

Similar examples abound. Businesses involved in managing high-value sites — transportation, oil and gas, power plants and agriculture to name a few — can leverage mass data collection to improve the speed and quality with which they acquire and use geospatial information for 3D, 4D and 5D analyses.

The growing demand for spatial data provides fertile ground for geospatial professionals. While many organizations may seek to develop in-house geospatial capabilities, many more will rely on outside expertise. This can present opportunities for geospatial firms to grow and profit by providing geospatial information to larger clients.

Smaller survey companies, which are still a mainstay of the industry, can use geospatial tools to differentiate themselves in a crowded market. They can provide data and services that deliver significant value — especially to large-scale organizations that have more people needing to share and use the data.

By understanding why their products and services are valuable, geospatial professionals can develop the flexibility and specialization needed to satisfy the growing demand. It boils down to their ability to provide accurate information and put it to work when and where it is needed.