Today Hewlett-Packard announced a program to invest over $1B in its Enterprise Services business for datacenter modernization, standardization and automation. The move is seen as a continuation of its efforts begun with the acquisition of Opsware (datacenter automation vendor) in 2007 and EDS over a year and a half ago to compete more effectively with IBM, Dell and others in enterprise services. The restructuring will impact around 9,000 jobs and consolidate data centers and management platforms over the next few years. The automation is important to HP’s strategy to deliver enterprise services at attractive prices while maintaining high quality, increasing their competitive advantage while leveraging their software assets more effectively.

Its sad when jobs go away, especially in tough economic times (HP also plans to add about 6000 jobs as a result of the transition), but the announcement is interesting for several reasons. The downstream benefits of automation at HP are estimated at $500M-$700M after the reinvestment. Certainly the move strengthens HP in the cloud services market and provides opportunity for HP to offer competitive services for customers to offload apps …

Today Hewlett-Packard announced a program to invest over $1B in its Enterprise Services business for datacenter modernization, standardization and automation. The move is seen as a continuation of its efforts begun with the acquisition of Opsware (datacenter automation vendor) in 2007 and EDS over a year and a half ago to compete more effectively with IBM, Dell and others in enterprise services. The restructuring will impact around 9,000 jobs and consolidate data centers and management platforms over the next few years. The automation is important to HP’s strategy to deliver enterprise services at attractive prices while maintaining high quality, increasing their competitive advantage while leveraging their software assets more effectively.

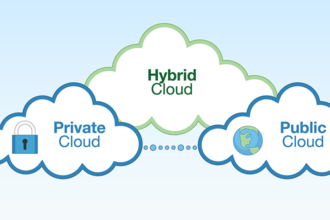

Its sad when jobs go away, especially in tough economic times (HP also plans to add about 6000 jobs as a result of the transition), but the announcement is interesting for several reasons. The downstream benefits of automation at HP are estimated at $500M-$700M after the reinvestment. Certainly the move strengthens HP in the cloud services market and provides opportunity for HP to offer competitive services for customers to offload apps from their own data centers but another attractive area of opportunity for cloud “arms dealers” like HP is in enterprise transition to private cloud. HP’s experience in transitioning its own operations to a more automated and consolidated structure provides some tangible evidence of significant cost and efficiency gains in private cloud, assuming that the benefits outlined come to fruition through the execution phase. HP’s own transition becomes a case study in datacenter automation for perspective enterprise private cloud customers.